20 year Term Life Insurance Review

By James Tobin, CFP®

Critical Takeaways

Bequest Mutual Rating

Expert Review Of 20 Year Term Life Insurance

Reviewed by

Jim Tobin, CFP®

Why you can trust this review

At Bequest Mutual, we value our editorial independence. We keep our reviews strictly factual so you can use them to make informed decisions. Life insurance carriers referred to on this site do not approve reviews.

20 year Term Life Insurance Review

If you are in the market for a 20 year term life insurance policy or simply want to research your options, you have landed in a good spot to do so. This article will run through the top rated life insurance companies and provide a comprehensive 20 year term life insurance review of carriers.

At the Bequest Mutual, while we do an annual list of the top term carriers, the truth is that one size does not fit all. Different companies are competitive in certain niches. Thus we try and write reviews of which carriers are most beneficial in certain niches like "20 year term life insurance".

If you would like to review carriers but are not sure about your term yet, you can browse through the carrier review archive here. The Bequest Mutual also provides a 10 , 15 & 30 year term life insurance review.

20 Year Term Life Insurance Review: Rates

This site goes to great lengths to explain the benefits of using an independent agent with lots of insurance companies available. While there are other issues worth mentioning, the difference in rates, and the condition specific underwriting that informs those rates, are the most important of those benefits. As such, let's take a look at 20 year term life insurance rates.

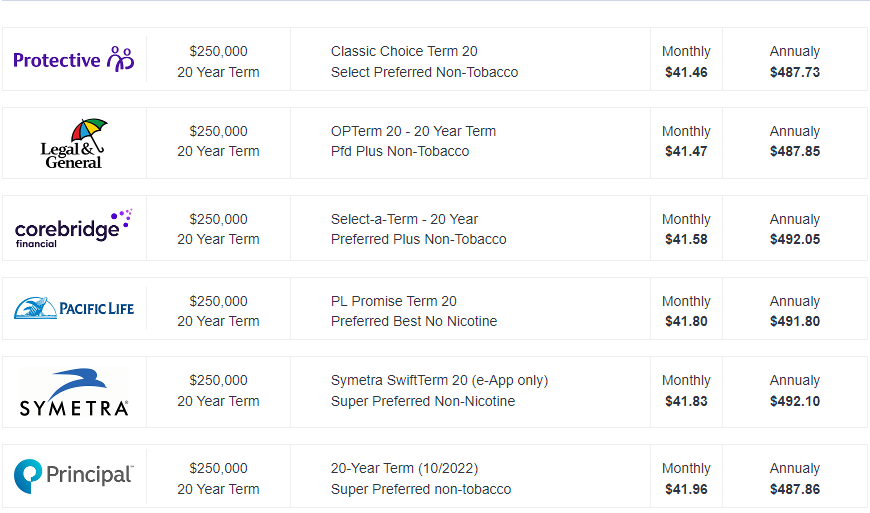

The following two screenshots shows a 250K quote for a 20 year term life policy for a 30 year old male in preferred plus category and a 50 year old male with a preferred plus health rating.

250K 20 year term life insurance quote 30 year old @ Preferred Plus

250K 20 year term life insurance quote 50 year old @ Preferred Plus

Notice, that while many of the carriers are the same, Prudential is in play for 50 year old's. This is important, because Prudential is materially more lenient on underwriting than its competitors. Therefore, if you had a borderline case, you would pay the extra $4 a month and get the Preferred Plus rate.

Quotes where preferred and preferred plus are truly accurate representations of the clients health, the life insurance application process is really quite easy. The the issues that matter other than price are run times (if you need it in a hurry), no medical exam life insurance options and available riders (such as living benefits and conversion privileges).

20 Year Term Life Insurance Review: Underwriting

The next comparison gets a little more tricky. We will compare 350k 20 year term policies for a 45 year old woman in the Standard Plus category and a 63 Year old woman rated Standard.

250k 20 year Term Life Insurance quote 45 Year Old @ Standard Plus

250k 20 year Term Life Insurance quote 63 Year Old @ Standard

While Banner Life remains the price leader in these comparisons, AIG becomes very competitive. However, when you get away from preferred and preferred plus health ratings, your specific health issues become very important.

Note that while Prudential Financial, a carrier with a well earned reputation for more liberal underwriting, becomes competitive for the 63 year old. This matters greatly, because if you wind up a class (or even 2) higher with Prudential than the price leader (when specific conditions are not considered) then you'd be much better off. This is all the more true when your health is considered sub-standard and you receive a table rating.

The vast differences in underwriting criteria from carrier to carrier and condition to condition can be overwhelming. Many of the condition specific posts on this site have case study examples of how this can cost or save you a lot of money. take a look at the case studies in the posts on Lupus or Crohn's disease to get a better idea about this issue.

20 Year Term Life Insurance Review: Exams And Turn Times

In addition to evaluating and assigning a category to your health, the term "underwriting" also refers to whether or not you are required to take an exam and how long it takes to get an final answer from the underwriting department.

Because the articles on this site are meant to stand up for some time, I am unwilling to spill digital ink on the turn times at specific carriers, when the truth is it regularly changes. There is no question that 'urgency" is a matter of corporate culture and I prefer to work with some more than others, however the changes happen so fast, it's not a good idea to include any pique I have in this post.

Suffice to say that we will always encourage applicants to go with the carrier who is at the time both competitive and easy to work with. Moreover, the advent of accelerated underwriting, which does not require a life insurance medical exam, is dramatically speeding up the underwriting process.

Although for different reasons than turn times, we are not free to advertise the carriers that are not using exams. The reason for this is that several carriers are afraid of "adverse selection" or, in plain English, applicants coming to them because they are afraid they will fail the exam.

Rest assured, if you are concerned about taking an exam, we will help you find a carrier who will not require one.

20 Year Term Life Insurance Review: Conclusion

Because different carriers are better at specific niches, in regards to both dollar amounts & age, as well as, gender and health conditions, the "top 10 life insurance companies" lists are of no real value. The real value is knowing the niche that a particular carrier excels.

Note that the Bequest Mutual ,with rare exception, will only recommend "A" rated or better carrier. You can see more about life insurance carrier financial ratings here.

The single best way to do this is to go through the process of choosing the terms you are interested in, gathering your medical history and speaking with an experienced independent agent.

Next Step

Thank You for choosing the Bequest Mutual to research 20 year term life insurance reviews. Should you have any questions please do not hesitate to call or email.