The Best $500000 Term Life Insurance Policy

By James Tobin, CFP®

Critical Takeaways

Expert Review Of The Best $500000 Term Life Insurance

Reviewed by

Jim Tobin, CFP®

Why you can trust this review

At Bequest Mutual life Insurance, we value our editorial independence. We keep our reviews strictly factual so you can use them to make informed decisions. Life insurance carriers referred to on this site do not approve reviews.

If you are, in the market, or researching the best $500000 term life insurance policy, you are in the right place. This article will discuss pricing and financial ratings at major insurers, underwriting issues, including no-exam options, and navigating existing conditions.

Do You Need A $500000 Term Policy?

When a client asks for a quote for 500000 dollars of term life insurance, my first question is "how did you arrive at that that number?". The reason I ask is that it's important not to just pick a round number that sounds good.

The fact is that life insurance whether $500000 or more (or less), is meant to cover specific needs. Therefore, it is important that you assess those needs ,and your budget, when deciding on a coverage amount.

I have found that, despite having access to complicated financial planning software, the best way to do a simple needs analysis is to use the acronym L.I.F.E.. That is, loans, income, future plans, and education. The LIFE formula is laid out below.

Loans - Add up all outstanding debt.

Income- Take your annual income and multiply by the number of years until you plan on retiring.

Future - Is there anything on the horizon that you know will have a significant cost?

Education - Do you plan on paying fully or partially the cost of one or more children's educations?

Adding these numbers together and optionally adding a conservative annual inflation adjustment, will give you a good idea of your "gross" need.

At this point you can subtract any savings and 70% of qualified retirement funds (unfortunately we have to be mindful of taxes). Additionally you can subtract any current, personally owned*,life insurance that will be in-force for a useful period (until an expense expires like college).

* I advise against using employer provided life insurance in this initial calculation, as there is no guarantee that a future employer will be able or willing to provide this benefit.

It is best to think of employer provided life insurance benefits as supplemental. This can be especially helpful if budgetary constraints force you into a less than "fully insured" position.

Rates For The Best $500000 Term Life Insurance Policy

So, after doing the L.I.F.E. calculation, if it turns out you were right all along, you'll want to know "how much for five hundred thousand dollars of term life insurance?'.

The answer can be super easy or much more complicated. We will deal with both scenarios. But before we get to the quotes, a quick note on the financial strength of carriers. With rare exceptions, Bequest Mutual only offers carriers that are A rated or better. You can learn more about the financial strength ratings of carriers here.

The super easy scenario is for people in good to excellent health. In these cases you simply use the quote tool and you have an answer.

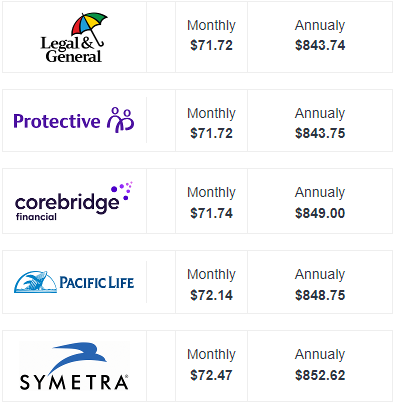

Below is a quote for a 38 year old male in excellent health. The underwriting category is "preferred plus", the best rating available.

Next is the quote for a 40 year old female in very good health. The rating used here was preferred, the second of the four primary non-smoking underwriting.

Okay, so that was the super easy portion of this quote, you can easily choose the a competitive carrier and submit your application. However, you only have the options available with an independent agent. Think if your agent only represented a carrier that is not as well priced as these that are listed. Would you know?

* Note that several carriers will do $500000 term policies with no exam for qualified applicants.

Now lets discuss if ,like lots of people, you have health history.

Why You Should Use An Independent Agent For The Best $500000 Term Life Insurance Policy With Health Condition(S)

Much of this site is dedicated to navigating the life insurance underwriting process with existing medical conditions. The issue is that different carriers have different risk appetites for specific conditions.. So, what is standard plus at one carrier may be table 2/B substandard at another carrier, and there is no way to know this by looking at the quote tool.

What you might not know is that different insurance companies will also treat each case differently.

For example Banner may have more of an appetite for the risk that Crohn disease presents than say Lincoln Financial. In this case the underwriting grade will reflect this increased appetite.

So, if your Agent only represented one carrier and you found out later that that you could have gotten a rate 10% or 35% better, how would you feel?

You'd probably be mad either at the agent or yourself or both. So it's important that your Agent can sell multiple carriers.

In fact a good independent agent will have access to over 50 carriers. This ensures the best chance at a good rate. It also gives you the opportunity to choose a carrier with better financials, or pick a no exam option.

Note that if he doesn't have access to multiple options, he probably may not be in a hurry to let you in on this information.

Case Study Of The Best $500000 Term Life Insurance Policy With An Existing Health Condition

So, I have been droning on about the importance of using an independent Agent and you may think that sounds a bit self serving coming from an independent agent.

You'd be are right, it is. However, it is also the (provable) truth.

As a way to demonstrate the importance of being able to shop different carriers on more than simply price, but also underwriting, we have taken this case study from our life insurance with high cholesterol page. It will show why it is in your interest to have as many options as possible available when shopping for life insurance with high cholesterol or any other impairment.

Gender: Male Age: 43

$500000 20 Year Term

Tobacco: No

Fairly well controlled High Cholesterol

HDL/LDL ratio of 5 & total cholesterol 275

Statin use (Crestor) No Other Health Concerns

This looks like a standard/preferred case that might get a better rating with one or two carriers. Depending on the insurers appetite for a cholesterol risk. Let's take a look at the rates.

- preferred

- Standard

This table which shows only a few of the major life insurance companies available illustrates the difference in rates. For standard rates Prudential is 15% more expensive than Protective.

On it's face this seems like a pretty straightforward choice and if underwriting grades between carriers is the same, it really can be that simple.

This kind of easy price shopping is particularly useful for younger folks in good health and demonstrates why you want to use an independent Agent.

For people who suffer from High Cholesterol or any other serious diagnosis, it gets much more complicated.

Because life insurers manage their appetite for specific risks by being more lenient or more stringent with underwriting grades, you need to know which company will grade you a preferred plus risk and which ones will grade you as standard.

In the case above Prudential (the most expensive standard rate) is likely to be the best deal if the agent does not have Banner at their disposal. This is because the more competitively priced carriers will likely rate the risk standard while Pru might well go Preferred Plus.

This is something you can't know by simply looking at the lowest price. In this hypothetical using an independent agent could save you 50% (the difference between Prudential @ Preferred plus and Protective @ Standard.

Your Next Step

Now that you know the information you will need to receive the best $500000 term life insurance policy, it's time to gather the information and speak to an independent Agent (raising my hand).

We are committed to totally transparent pricing (we'll even share our computer screen with you if you'd like), and making the application process as painless as possible.

Thank you for using the Bequest Mutual to research the best $500000 term life insurance policy. Should you have any questions, please do not hesitate to contact us. Call (203) 424-1100 or just send an email over.