Life Insurance With Type 2 Diabetes

By James Tobin, CFP®

Key Takeaways

Bequest Mutual Life Insurance Rating

Expert Review Of Life Insurance with type 2 diabetes

Reviewed by

Jim Tobin, CFP®

Why you can trust this review

At Bequest Mutual Life Insurance, we value our editorial independence. We keep our reviews strictly factual so you can use them to make informed decisions. Life insurance carriers referred to on this site do not approve reviews.

As a life insurance professional and someone who has to be cautious with sugar levels, I decided that this latest post for the Bequest Mutual Life Insurance site would be about obtaining life insurance with type 2 diabetes.

With the epidemic of type 2 diabetes in full swing, life insurance carriers are trying to adapt to demand. The result is rapidly changing underwriting standards for a disease that was once insurable only by final expense carriers.

Carriers for life insurance with type 2 diabetes, will want to know as much as they can about the risk they are being asked to insure. This is no different than how the carriers deal with any other pre-existing condition like high blood pressure and depression, or lifestyle choices like smoking or scuba diving.

The purpose of this article is to provide all the information needed to get the best possible deal on life insurance with type 2 diabetes.

Can I Be Approved For Life Insurance With type 2 diabetes?

Obtaining life insurance with Type 2 diabetes is certainly possible.

However, the policy type that you can obtain and the rates you’ll have to pay will be dictated by the severity of your Type 2 diabetes condition, your general health, and how well you’ve been keeping your condition in check.

As underwriters apply different standards for different kinds of insurance policies, we’ve divided this review of life insurance options with type 2 diabetes into 3 sections (You can click on the button to directly enter the relevant section)

Best Price

Strict Underwriting

Exam - Yes

Good Price

Strict Underwriting

Exam - No

More Expensive

Easy Underwriting

Exam - No

What Information Will Life Insurance Companies Want To Know?

Insurance underwriters will ask you about your symptoms, how severe they were, the treatment options you’ve been recommended and undergone, the medications you’ve been using, and your compliance with doctor’s appointments and follow-up.

The following information will be used to provide you with an accurate insurance quote, based on your condition.

A1C and blood glucose levels

Treatments undergone along with evidence of other procedures

Date of your diagnosis

Other major health issues you currently have

Will I Need To Take An Exam For High type 2 diabetes Life Insurance?

If you want to obtain the best possible insurance rates, you’ll have to undergo an exam. If your type 2 diabetes condition has been managed exceedingly well, you may qualify for no-examination underwriting. But serious cases will have to mandatorily undergo a paramedical exam, where your urine and blood samples will be collected. A traveling nurse will administer the exam at your convenience.

But if you’d like to opt for guaranteed issue or simplified issue policies, you won’t be required to undergo any kind of medical exam.

How Much Will My Life Insurance Cost And How Exactly Are My Rates Affected By My type 2 diabetes Levels?

Your insurance rates will be dictated by which underwriting category you fall into, which will be done by your carrier. An individual with type 2 diabetes is typically given a standard rating or lower.

While we did state that everybody can qualify for an affordable insurance option even if they have type 2 diabetes, note that ‘affordable’ doesn’t mean ‘cheap’ or ‘inexpensive’. People with type 2 diabetes are unlikely to have access to the same options that healthy young people do; but we make every effort to get you the most cost-effective deal.

Finding a policy that works best for you can be a difficult process, especially with Type 2 diabetes. Different insurance carriers have different standards, risk appetites, and ratings for customers with certain conditions. Due to the complexities involved, it isn’t simply a case of purchasing the cheapest option around – you have to analyze your options in greater detail, which we’ve done for you in a case study given below in this review.

You can also access sample pricing estimates for guaranteed issue and simplified issue insurance policies in the links.

Possible Underwriting Ratings For Life Insurance With Type 2 Diabetes

Since insurance applications are mostly evaluated on their own merits, it’s important to ensure your cover letter and story help you bag the best rates.

You may be surprised to learn that 2 people from the very same age group and medical condition may be given vastly different quotes from the very same insurance carrier. Why? Due to differences in patient compliance history and time elapsed since the diagnosis.

Since every case is unique, the pricing scenarios presented here are only estimates but are grounded in solid experience.

Best Case Scenario – Individuals who have their type 2 diabetes under control with A1C levels under 6.5 will be able to obtain a standard rating. This is even if they’re using oral prescription medication. The insurance quote tool here can be used to obtain a reliable quote.

Mid Case – Individuals who have their type 2 diabetes somewhat under control with A1C levels under 7 may be able to obtain standard rates, provided they’re over the age of 45. But they shouldn’t have any other major health issues.

If you want to know more about table ratings, click here.

Tough Case – Individuals who don’t have their condition under control with A1C levels exceeding 8 but who are undergoing active treatment may be eligible for substandard offers given in Tables 2/B to 4/D, based on how severe their case is.

Decline – Severe cases where type 2 diabetes has spiraled out of control with ineffective effort on the applicant’s part to control it may be rejected for traditional coverage You’ll have no choice but to go for policies with a lower face value, which are also known as simplified issue or Guaranteed issue. Contact us today if you’re one of these unfortunate individuals and we’ll help you out!

How Accurate Are The Type 2 Diabetes Life Insurance Quotes I Get From Your Quote Tool?

We’ve made every effort to ensure our quote tool offers you 100% reliable insurance quotes for your condition. However, you need to be careful while entering the information and get your rate class right – unless you do this, you’ll end up with faulty insurance quotes that serve no one’s purposes.

If you’d like some help, fill out our customized quote form – we’ll reach out to you and clarify all your doubts. You can also select a range on our quote tool and find a reasonably accurate insurance quote.

How Can I Improve My Underwriting Rating And Lower My Diabetes Life Insurance Cost?

For starters, use the services of an agent who knows the industry well and can get you favorable terms, thanks to their inside access to people within the insurance companies.

You can read the section below on "Why to use Independent Agent when Shopping for Life Insurance with type 2 diabetes" to learn more about the pros of using independent agents.

So far as lifestyle is concerned, take your exercise and diet seriously. Quit smoking and limit your alcohol consumption as well, which can help you score extra brownie points.

Document your efforts to comply with medical advice given by your doctor and how regularly you’ve been taking your medication. A letter from your doctor acknowledging your compliance with his instructions and steady improvement on your part can also work in your favor.

What Are The Best Life Insurance Companies For type 2 diabetes?

An experienced insurance agent can help influence things in your favor and get you favorable pricing terms from the companies, even if you have a major health condition.

Why You Should Use An Independent Agent When Shopping For Life Insurance With Type 2 Diabetes

Since you’ve already understood how your story is important and that 2 people suffering from the same condition can be handed different quotes by the same carrier, here’s something else – different insurance firms may treat the same condition differently as well.

For instance, SBLI is likelier to accept Type 2 diabetes applicants and give them favorable terms, compared to Assurity. You’ll see this in their underwriting standards.

Imagine what would happen if your insurance agent was a representative of only a single carrier? They’d push that one aggressively when in fact, there are other options out there that are cheaper by 35% or even 45%.

Working with an independent agent is the best way to counter this issue since most of them have tie-ups with 40-50 carriers, which can help you score the best deals.

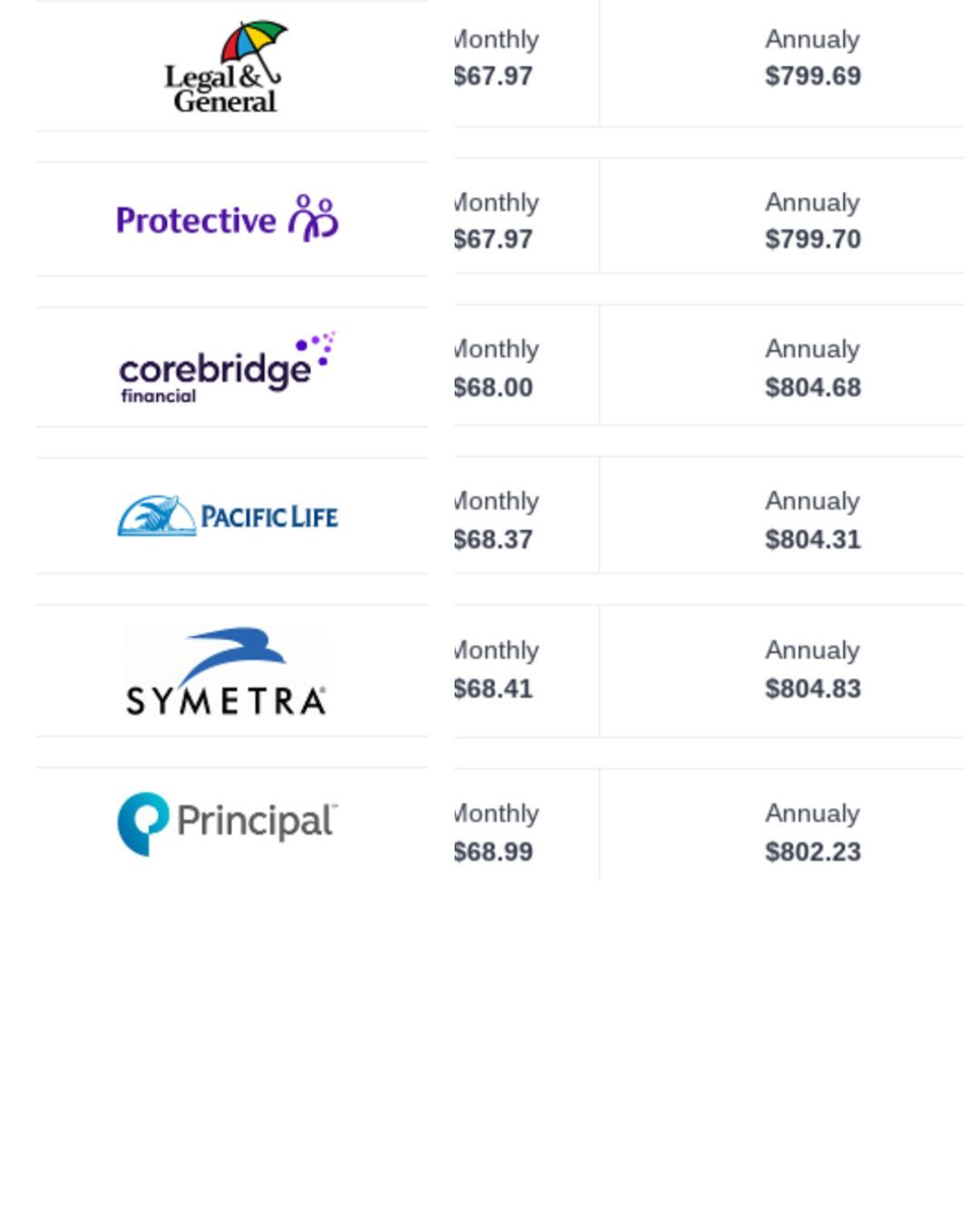

Case Study Pricing Life Insurance With Type 2 Diabetes

Please see the case study below . it will show why it is in your interest to have as many options as possible available when shopping for life insurance with type ll Diabetes or any other impairment.

Male Age: 50

$250000 20 Year Term

Tobacco: No

Fairly well controlled Diabetes (type ll)

A1C of 7.3

Oral medication Metformin 500mg

This looks like a standard case that might get a better rating with one or two carriers, depending on the insurers appetite for a diabetes risk. Let's take a look at the rates.

- Table 2/B

- Table 4/D

What we’ve presented here is a standard profile, which a few carriers may assign a standard insurance rating, based on their risk appetite for Type 2 diabetes cases. Let’s analyze the rates now.

The table provides information about the premium rates offered by leading life insurance carriers. A simple look reveals that Prudential’s policies are 20% costlier compared to Lincoln.

But things are rarely so straightforward, eh? Unless you’re assigned the same underwriting category by both insurers, it’s not a black-and-white choice.

Different life insurers have different standards for the same condition. Your priority is to find out which carriers will rate you as standard and which ones with rated you preferred plus.

And what you’ll see here is that though Prudential has the costliest deal here, they’ll rate you as Standard whereas other carriers will place you in the substandard category and impose the rates found in Table 2.

That’s a whopping 50% difference between Lincoln @ Table 2 and Prudential @ Standard – precious money you’d be giving away if you didn’t use an independent insurance agent to tell you otherwise. Unless you know all the ins and outs of the industry, engaging the services of an independent agent will always net you the best deals.

Next Step

Now that you know the information you will need to receive the most accurate quote possible, it's time to gather the information and speak to an independent Agent (raising my hand).

Simply give us a call or shoot an email over and we can get you started.

We are committed to totally transparent pricing (we'll even share our computer screen with you if you'd like), and making the application process as painless as possible.

Thank you for reading about life insurance with type 2 diabetes, if you have any questions, we'd like to hear them.

Fast Facts about type 2 diabetes

According to the National Institutes of Health, about 29 million people or 9 % of the U.S population is diabetic.

Type ll diabetes represents 95% of all sufferers, and one in four people suffering from type ll diabetes are unaware of their condition.

One in four adults over the age of 65 is a type ll diabetic.

Obesity, age, physical inactivity and race all play a factor in the onset of diabetes.

Some of the more famous people who have suffered from type ll diabetes are: actor Tom Hanks, celebrity chef Paula Dean, basketball great Earl Monroe, actress Halle Berry, and presidential candidate Mike Huckabee.