INTRODUCING

SMART BEQUEST

Learn how to leverage life insurance to increase your charitable bequests without sacrificing your lifestyle.

Are you interested in learning more about how you can increase the value of your charitable gifts by leveraging life insurance? If so, you are in the right place.

Each year vast sums of money are donated to charitable organizations through bequests outlined in the wills of the recently departed. While these generous donations are gratefully received, there are times when, with some planning, life insurance can be used to multiply the gift amount at no additional cost to the donor.

Smart Bequest facilitates life insurance bequests for you by running illustrations, shepherding your application through the underwriting process, and providing a directory of legal help for any required will and trust work.

Now, in order to use life insurance to maximize charitable donations, the prospective donor must:

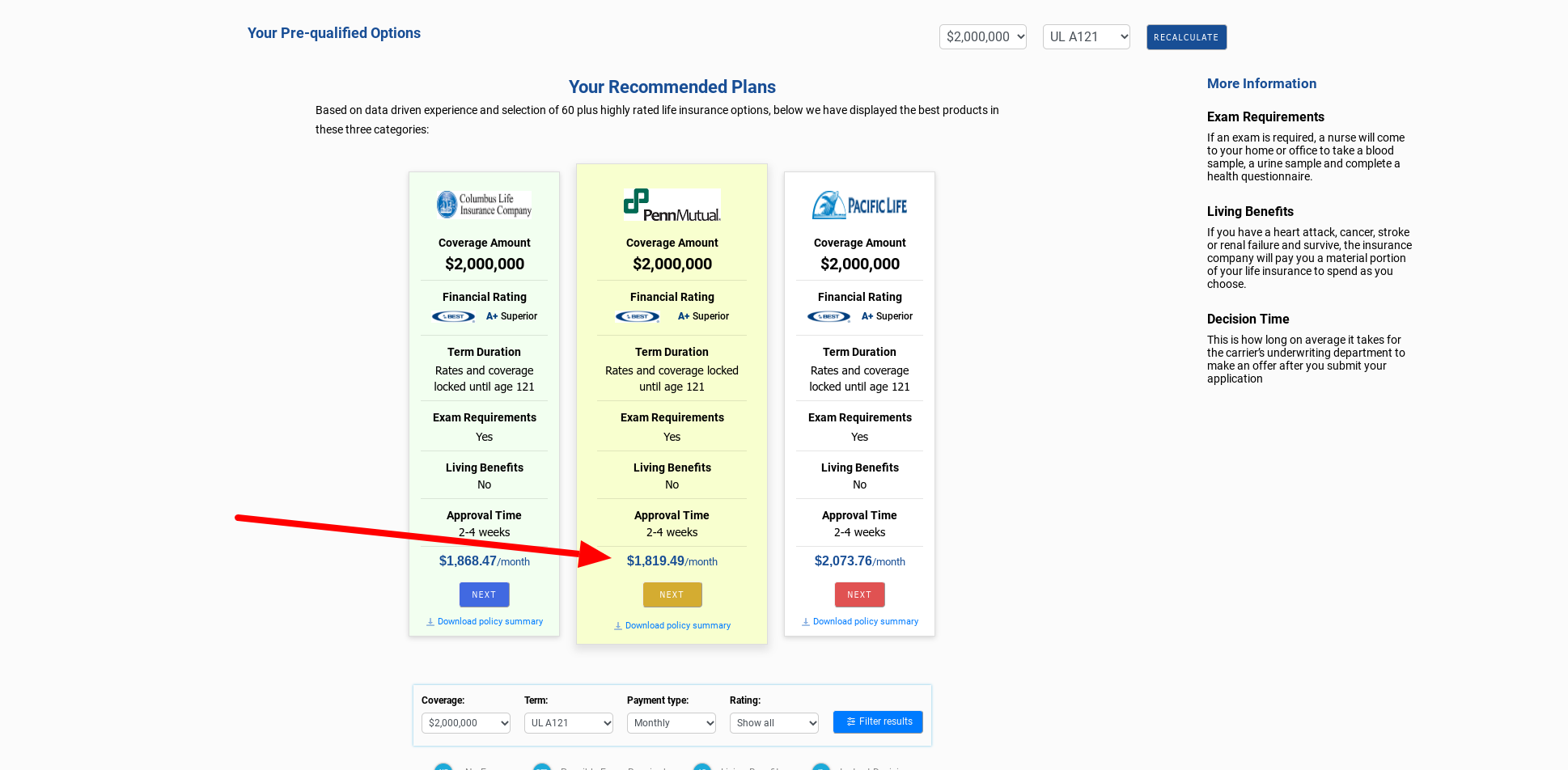

The best life insurance product to facilitate a bequest on death is Guaranteed Univeral Life (GUL). The reason for choosing GUL is that term insurance, while less expensive, may expire before the donor’s death, and the cost of whole life insurance limits flexibility and leverage.

Case Study

Let’s take a look at an example of how GUL can be used to increase donation value.

Nicole, age 54, has no children and is financially comfortable. However, the comfort has come at a cost. Her husband Tom a dentist, died tragically from a heart attack at age 49. Upon Tom’s death, Nicole sold the dental practice and received a large payout from a life insurance policy her husband had taken out.

Nicole now spends much of her time doing volunteer work associated with heart disease. She would like to bequeath a significant gift to a heart-related charity upon her own death. Below are the particulars.

$2,000,000

GUL (age 121)

Female

Age : 54

Non Smoker

Good Health

$1819/mo.

$21,246/yr.

In the example above Nicole can pay $21,246/yr. and upon her heath a $2,000,000 bequest can be made in her name to her charity. If she lives to the current life expectancy for females in the United States of 79 years, she will pay $531,150 in exchange for the $2MM benefit. This is not a bad return when one considers that the return is guaranteed.

It is worth noting that the money used to pay premiums could be invested in the equities market and possibly see a more favorable return. However, the potential upside in the market is neither guaranteed nor immune from loss. Additionally, even long periods of market growth are dotted with significant downswings that cannot be timed. So, even a strong equities market faces the timing risk of being significantly down when the donor passes. These are risks that are eliminated by using permanent life insurance to fund charitable pursuits.

If you would like to run an illustration or have any questions about Smart Bequest, give us a call or reach out here.