Life Insurance with Tobacco Use

By James Tobin, CFP®

Critical Takeaways

Bequest Mutual Difficulty Rating

Expert Review Of Life Insurance With Tobacco Use

Reviewed by

Jim Tobin, CFP®

Why you can trust this review

At Bequest Mutual Life Insurance, we value our editorial independence. We keep our reviews strictly factual so you can use them to make informed decisions. Life insurance carriers referred to on this site do not approve reviews.

From cigarettes and cigars to vaping and chewing tobacco, it's a pretty good bet that if you don't use tobacco, someone you know does.

As someone who grew up watching a parent go through medical complications related to smoking, and who still has friends and family members who use tobacco, I feel blessed this is not on my personal list of vices..

You may know about the daily expenses of tobacco as well as the related health concerns. what you may not know is how tobacco use will impact your life insurance application.

The purpose of this article is to provide the information necessary, regardless of how you use tobacco, to get the best possible deal on life insurance.

What Is Tobacco Use

At first blush this may seem like a ridiculous question. After all you know if your smoking cigarettes / cigars or vaping, dipping ..etc

However when it comes to life insurance underwriting it's not nearly as simple as that...

You see, much like other "health impairments", smoking is viewed differently by different carriers.

For some ( most actually) eating marijuana edibles would put you in the smoker category. For others, the occasional cigar or cigarette can be overlooked.

The list of items that can get you classified as a smoker are

- Cigarettes

- Cigars

- e-cigarettes

- Vaping

- Chewing Tobacco

- Dip (smokeless tobacco)

- Marijuana use

Generally, the answers are carrier specific and revolve around frequency of use. Frequency is determined by your answers to application/interview questions and telltale traces detected in your blood or urine.

Tobacco Test for Life Insurance

When you apply for term life insurance, you may need to take a paramedical exam. This is a brief encounter with a nurse/tech , and as part of it, you’ll be asked for blood and urine samples. The carrier will then run labs to test your alcohol, drug and nicotine levels, and then use this information in deciding your health class.

If you use these tobacco products, your blood will test positive for nicotine/cotinine:

- Cigarettes

- Chewing tobacco

- Cigars

- "Quit Smoking" patches/products that contain nicotine

Possible Underwriting Grades For Tobacco Use

Believe it or not, all categories are available from preferred plus to decline depending on the substance being used and the frequency of use.

Preferred Plus- a preferred plus rating is possible with a limited number of carriers for very infrequent use (1X month) of cigarettes, cigars, and marijuana. underwriting guidance on e-cigarettes, vaping and is less clear at this point.

Preferred - a preferred rating may be available for applicants who use infrequent but more than preferred plus (2X month)

Standard- This classification may be available to users with a limited use history that is more than the preferred criteria but less than smoker. It is impossible to be precise here as every carrier has different guidelines.

Preferred Smoker- This classification has less to do with frequency of use and more to do with your general health apart from being a smoker.

Standard Smoker- This is the classification that applicants get who don't meet the limited use categories nor the Preferred smoker category.

Substandard or Decline- With the exception of heavy marijuana use, declines do not happen for smoking alone. Rather, the applicant has other serious condition(s) that result in a declination.

If you have been declined for life insurance, you may qualify for a guaranteed or graded policy. please contact us to learn your best options.

Why You Should Use An Independent Agent When Shopping For Life Insurance With Tobacco Use

Because different insurance carriers view each case independently, your personal circumstances matter.

Your agent should craft a cover letter for your application putting your story in the best possible light. this will give you the best chance to get the best rate available.

So now you know that your individual story matters...

What you might not know is that different insurance companies will also treat each case differently.

For example Prudential Financial may have more of an appetite for the risk that smokeless tobacco (dip) presents than say Banner. In this case the underwriting grade will reflect this increased appetite.

So, if your Agent only represented one or two carriers and you found out later that that you could have gotten a rate 37% or 49% better, how would you feel?

You'd probably be sad ...or mad at the agent or yourself or both. So it's important that your Agent represent multiple carriers.

In fact a good independent agent will have access to over 50 carriers. This ensures the best chance at a good rate.

Note that if he doesn't, he likely won't be in a hurry to tell you in on this info.

How Will Tobacco Use Affects My Rates?

Based on what you have already read you know that your rating will depend on what kind of tobacco you use and how often.

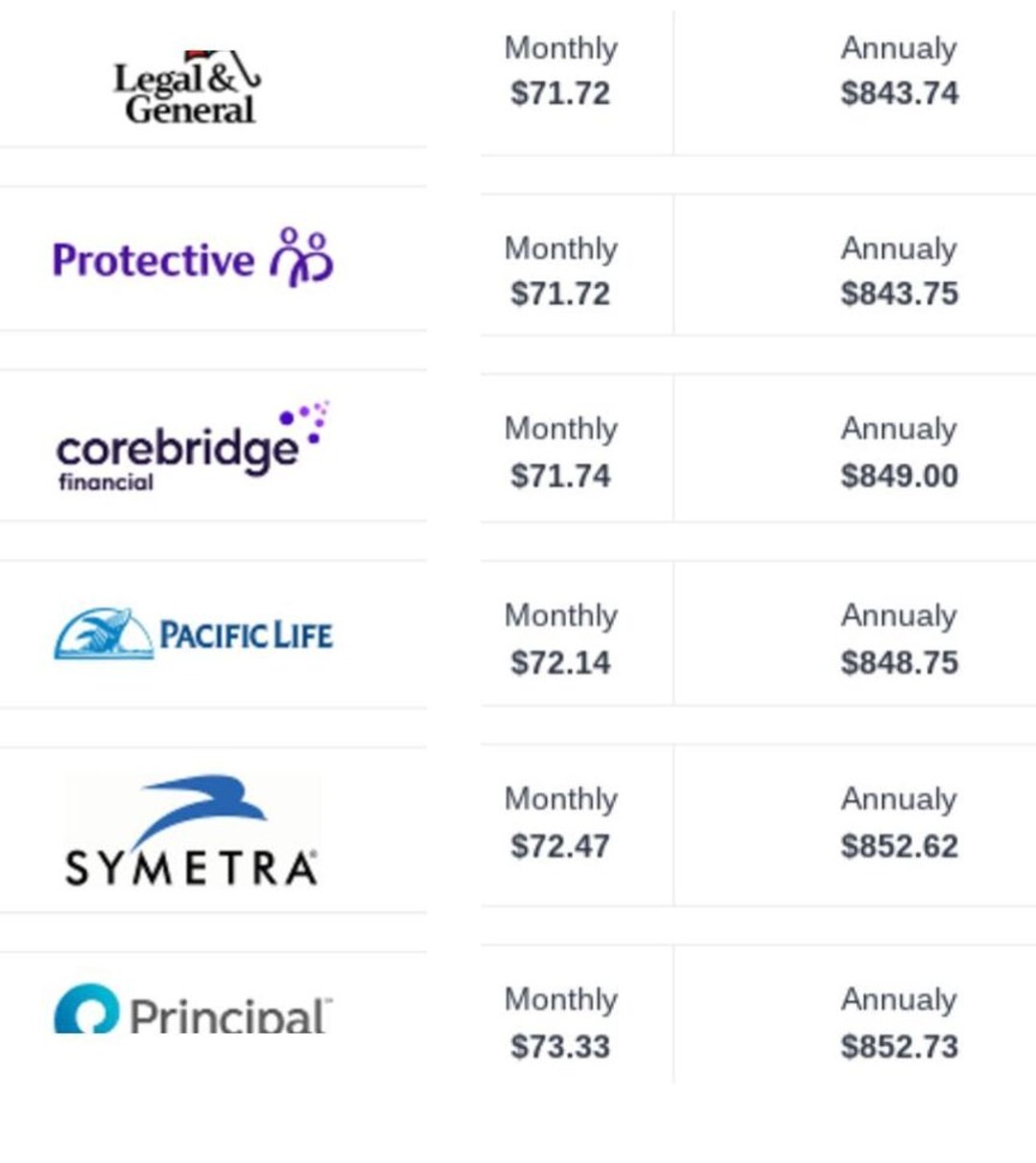

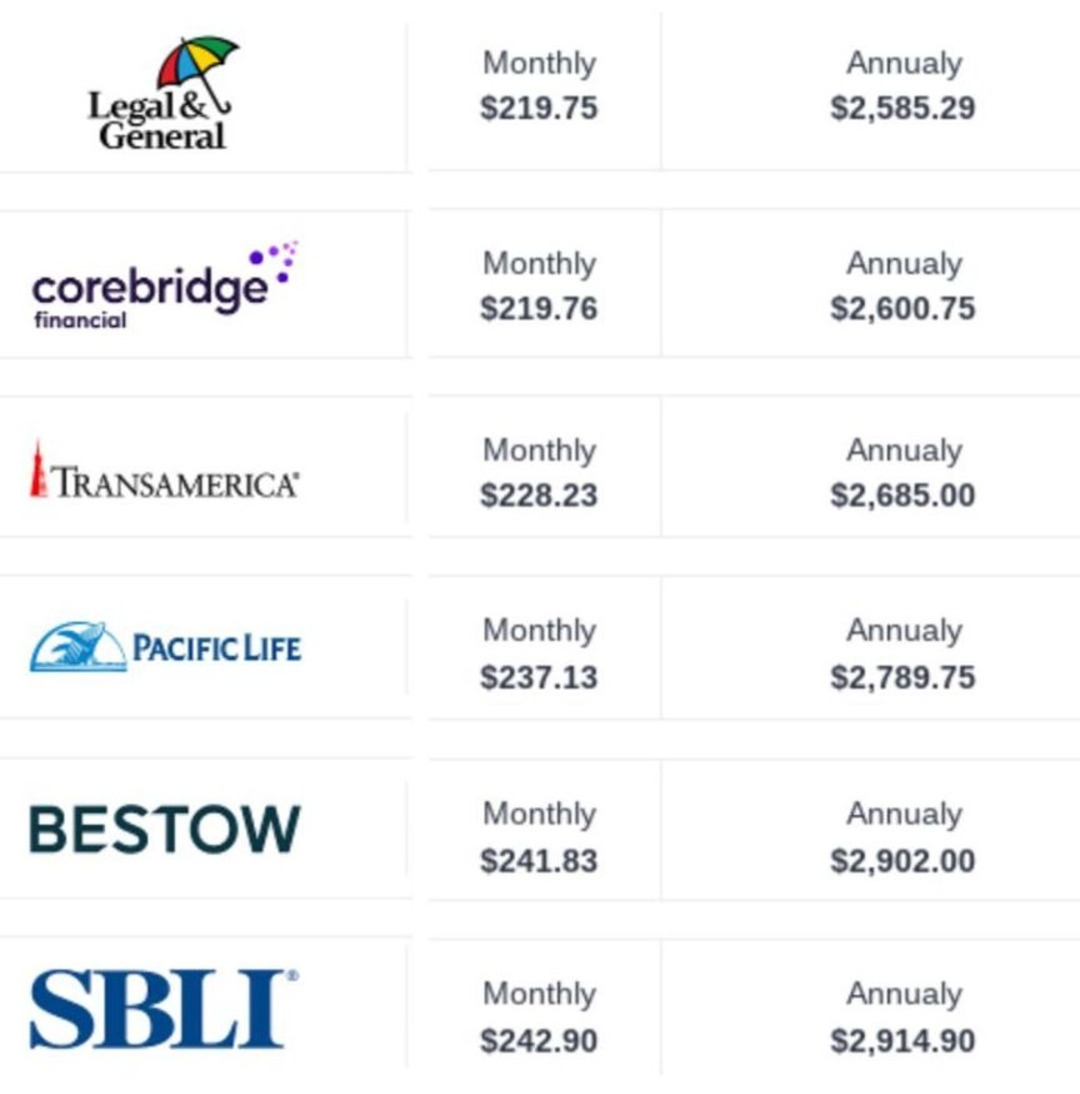

The case study below will give you an idea of how pricing would be affected.

So, I have been coming on pretty strong about the importance of using an independent Agent and you may think that sounds a bit self serving coming from an independent agent.

It's true, it is self serving, but it's also (provably) true. Consider this example

Gender: Male Age: 43

$500000 20 Year Term

Tobacco: 2 times a month cigar smoker

Statin use (Crestor) No Other Health Concerns

This looks like a case that can go anywhere from Preferred to Preferred Smoker depending on the insurers appetite for a cigar smoke risk.

Let's take a look at the rates.

- preferred

- Standard

This table which shows only a few of the major life insurance companies available illustrates the difference in rates. For standard rates Prudential is 33% more expensive than Banner.

Because life insurers manage their appetite for specific risks by being more lenient or more stringent with underwriting grades, you need to know which company will grade you a preferred rating and which ones will grade you as a smoker.

In the case above Prudential or Mutual of Omaha (the most expensive standard rates) are likely to be the best deals because the more competitively priced carriers will likely rate the risk preferred smoker while Pru or MoO might well go standard.

This is something you can't know by simply looking at the lowest price. In this case using an independent agent could save you 94% (the difference between Prudential @ standard and Banner @ Preferred Smoker).

Your Next Step

Now that you know the information you will need to receive the most accurate quote possible, it's time to gather the information and speak to an independent Agent (raising my hand).

Simply give us a call or shoot an email over and we can get you started.

We are committed to totally transparent pricing (we'll even share our computer screen with you if you'd like), and making the application process as painless as possible.

If you have any questions, We'd like to hear them.